The Competitive Landscape

Niche Traffic Leaders

Big box retailers dominate through sheer domain authority, they're not our competition. Similarly, Polywood's 107.8k brand searches put them in a different league entirely.

Our opportunity is 5,789 keywords where niche brands actually rank, generating 3M+ monthly searches with 107,978-125,976 traffic potential.

Even Terra Outdoor, the current leader with 51k monthly visitors, captures only 24% of our identified potential keywords. Based on their top 30 ranking keywords, they achieve a 5.87% search-to-traffic conversion rate.

Over-Performers: Traffic Value vs Domain Rating

Performance Efficiency Score

Switching our analysis to Traffic Value vs Domain Rating (DR) reveals our over performers. These brands are performing well despite a low level of backlinks/authority, usually a key part of SEO.

TheOutdoorLivingStores are the clear winner and outlier in our data, with a DR of only 3.8 and 21.5k non-branded organic traffic.

DuraWeather and Poly Lumber Furniture are also strong performers, with DR 12 and 16, yet 15.9k and 3.8k monthly non-branded organic traffic. While 3.8k may seem low, it's still high for a DR16 website (in any market).

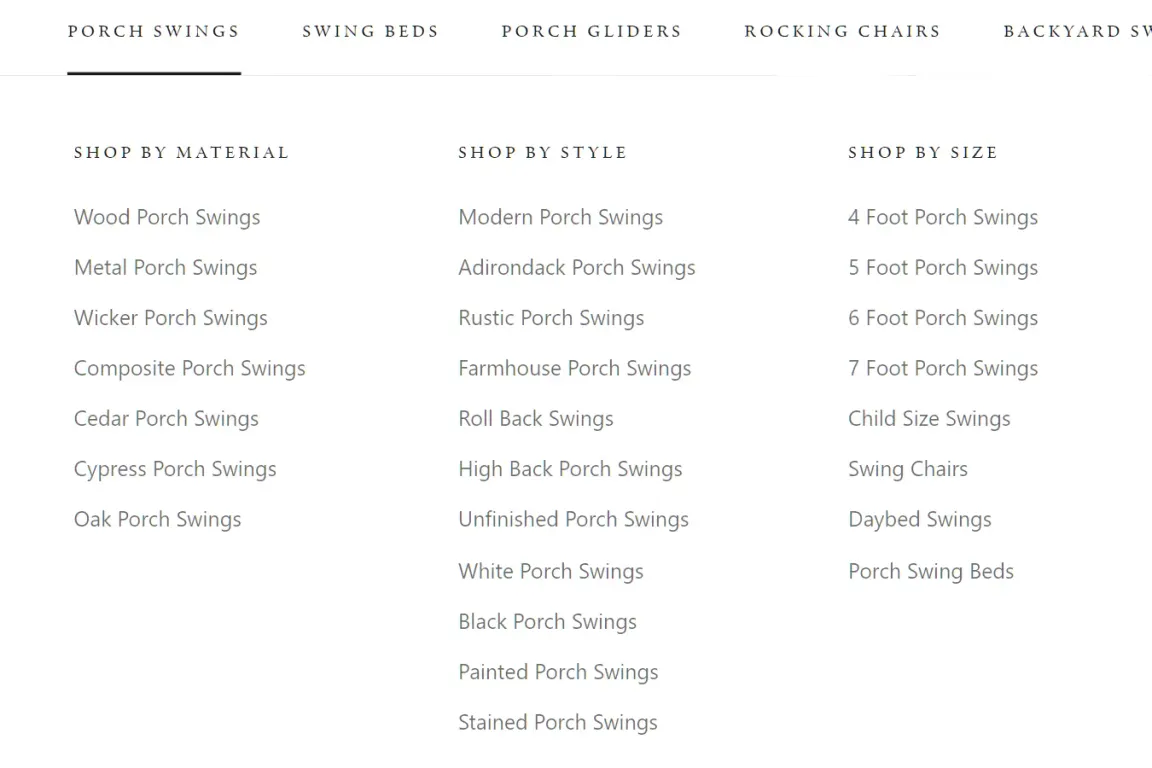

Analysis of these over-performing brands reveals some useful insights:

- TheOutdoorLivingStores receive the majority of their traffic by ranking for "patio furniture" with 143k averaged monthly searches.

- Poly Lumber Furniture rank mostly for Polywood branded keywords, which are mostly uncompetitive, besides the top position taken by Polywood themselves.

- DuraWeather are much the same as Poly Lumber Furniture, with a strong 4th position ranking for "adirondack chairs" bringing in 23% of their traffic.